cloud computing in banking

Ads

Introduction

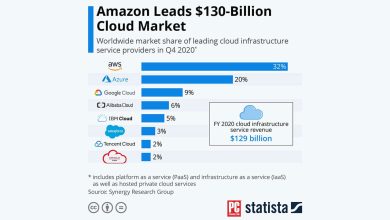

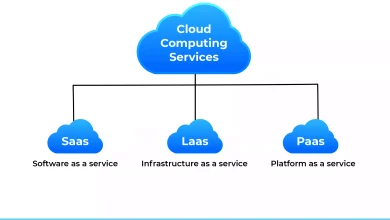

Cloud computing has transformed various industries, and banking is no exception. The adoption of cloud technology in the financial sector has brought numerous benefits, such as increased efficiency, cost savings, and enhanced security measures. This article delves into the world of cloud computing in banking, exploring its strengths, weaknesses, and the overall impact it has on the industry.

Cloud Computing in Banking: The Strengths

1. Enhanced Security Measures

One of the key strengths of cloud computing in banking is the enhanced security measures it offers. Cloud service providers invest heavily in state-of-the-art security protocols to safeguard sensitive financial data. This helps banks protect their customers from potential cyber threats and data breaches.

2. Cost Savings

Cloud computing allows banks to reduce their operational costs significantly. By moving their data storage and processing to the cloud, banks can eliminate the need for expensive on-premise infrastructure and hardware. This results in cost savings that can be passed on to customers through lower fees and better services.

3. Scalability and Flexibility

Cloud computing provides banks with the flexibility to scale their operations seamlessly. Whether it’s expanding customer services, launching new products, or entering new markets, the cloud can accommodate the growing needs of a bank without the hassle of investing in additional infrastructure.

4. Improved Efficiency

With cloud computing, banks can streamline their operations and improve efficiency. Cloud-based applications and services enable faster data processing, real-time analytics, and automated workflows. This not only enhances the customer experience but also boosts internal processes.

5. Disaster Recovery and Business Continuity

Cloud computing provides banks with robust disaster recovery and business continuity solutions. In the event of a natural disaster, cyber attack, or system failure, banks can quickly recover their data and resume operations without any significant downtime, ensuring uninterrupted service to customers.

6. Innovation and Competitive Edge

By embracing cloud computing, banks can drive innovation and gain a competitive edge in the market. Cloud technology enables banks to experiment with new products and services, test innovative solutions, and stay ahead of the competition in terms of digital transformation and customer engagement.

7. Environmental Sustainability

Cloud computing promotes environmental sustainability by reducing the carbon footprint of banks. By transitioning to the cloud, banks can minimize the energy consumption of their data centers, decrease the use of paper-based processes, and contribute to a greener and more sustainable future.

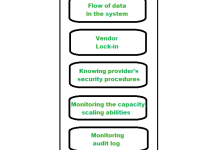

Cloud Computing in Banking: The Weaknesses

1. Data Security Concerns

Despite the enhanced security measures offered by cloud providers, data security remains a top concern for banks. Storing sensitive financial information in the cloud exposes it to potential risks such as data breaches, cyber attacks, and unauthorized access. Banks must ensure strict compliance with data protection regulations and invest in robust security measures to mitigate these risks.

2. Regulatory Compliance Challenges

Regulatory compliance is a major challenge for banks adopting cloud computing. Financial institutions must adhere to strict regulations and data privacy laws when storing and processing customer data in the cloud. Ensuring compliance with global and industry-specific guidelines can be complex and time-consuming, requiring banks to invest in compliance management tools and expertise.

3. Dependence on Third-Party Providers

Cloud computing in banking involves reliance on third-party providers for data storage, processing, and security services. Banks must carefully select trustworthy and reliable cloud partners to ensure the protection of their data and maintain service continuity. Any disruptions or downtime from cloud providers can impact the operations and reputation of a bank.

4. Data Accessibility and Control

Concerns regarding data accessibility and control arise with cloud computing in banking. Banks may face challenges in accessing and managing their data stored in the cloud, leading to potential data loss, corruption, or unauthorized modifications. It is essential for banks to establish clear data governance policies and system controls to maintain data integrity and prevent misuse.

5. Network Connectivity Issues

Network connectivity issues can affect the performance of cloud-based banking services. Banks rely on stable and high-speed internet connections to access cloud resources seamlessly. Any disruptions in network connectivity, such as outages or latency issues, can impact the availability and reliability of online banking services, leading to customer dissatisfaction.

6. Vendor Lock-In Risks

Vendor lock-in risks are a concern for banks using cloud computing services. Banks may become dependent on a single cloud provider for their data storage and processing needs, limiting their flexibility to switch providers or negotiate better terms. To mitigate vendor lock-in risks, banks must evaluate multiple cloud options, negotiate contractual terms carefully, and plan for data migration strategies.

7. Data Privacy and Confidentiality

Ensuring data privacy and confidentiality is crucial for banks leveraging cloud computing. Banks must implement strong encryption protocols, access controls, and data masking techniques to protect sensitive customer information stored in the cloud. Any breaches of data privacy can lead to legal liabilities, financial losses, and reputational damage for a bank.

Table: Cloud Computing in Banking Overview

| Category | Strengths | Weaknesses |

|---|---|---|

| Security Measures | Enhanced security protocols to protect sensitive data | Data security concerns and regulatory compliance challenges |

| Cost Savings | Reduced operational costs and infrastructure expenses | Dependence on third-party providers and vendor lock-in risks |

| Scalability and Flexibility | Ability to scale operations and services easily | Data accessibility and control issues and network connectivity challenges |

| Efficiency | Streamlined operations and improved efficiency | Data privacy concerns and dependence on cloud providers |

Frequently Asked Questions (FAQs) about Cloud Computing in Banking:

1. What is cloud computing and how is it used in banking?

Cloud computing refers to the delivery of computing services over the internet to store, manage, and process data. In banking, cloud computing is used to enhance security measures, reduce operational costs, and improve efficiency.

2. What are the benefits of cloud computing in banking?

The benefits of cloud computing in banking include enhanced security measures, cost savings, scalability and flexibility, improved efficiency, disaster recovery capabilities, innovation opportunities, and environmental sustainability.

3. What are the risks associated with cloud computing in banking?

The risks associated with cloud computing in banking include data security concerns, regulatory compliance challenges, dependence on third-party providers, data accessibility and control issues, network connectivity problems, vendor lock-in risks, and data privacy and confidentiality issues.

4. How can banks ensure data security in the cloud?

Banks can ensure data security in the cloud by implementing strong encryption protocols, access controls, data masking techniques, and compliance with data protection regulations. Regular security audits, monitoring, and incident response plans are also essential to safeguard sensitive information.

5. What steps should banks take to address regulatory compliance challenges in cloud computing?

To address regulatory compliance challenges in cloud computing, banks should establish clear data governance policies, conduct risk assessments, ensure data localization compliance, implement data residency controls, and maintain audit trails to track data usage and access.

6. How can banks mitigate vendor lock-in risks with cloud computing?

Banks can mitigate vendor lock-in risks with cloud computing by evaluating multiple cloud providers, negotiating flexible contracts with exit clauses, planning for data migration strategies, maintaining transparency about data ownership and control, and diversifying cloud services to avoid dependency on a single provider.

7. What are the best practices for banks to ensure data privacy and confidentiality in the cloud?

The best practices for banks to ensure data privacy and confidentiality in the cloud include encryption of sensitive data, user access controls, secure data transmission, regular security training for employees, compliance with data protection laws, monitoring of data activities, and incident response protocols for data breaches.

Conclusion: Embracing the Future of Banking with Cloud Computing

As technology continues to evolve, cloud computing remains at the forefront of digital transformation in the banking sector. Despite the challenges and risks associated with cloud adoption, the benefits far outweigh the drawbacks, paving the way for a more efficient, secure, and innovative banking experience. Banks that embrace cloud computing have the opportunity to revolutionize their operations, drive growth, and stay ahead in a rapidly changing financial landscape.

It is essential for banks to assess their readiness for cloud migration, address the key concerns, and leverage cloud technology to enhance customer service, optimize processes, and achieve competitive advantage. By harnessing the power of the cloud, banks can unlock new opportunities, accelerate innovation, and shape the future of banking in the digital age.

Whether it’s improving data security, reducing costs, or enabling scalability, cloud computing offers endless possibilities for banks to transform their operations and deliver value to customers. The time is now for banks to embrace the future of banking with cloud computing and drive sustainable growth in a dynamic and competitive industry.

Take the leap into the cloud and embark on a transformational journey that will redefine the way banking is done. Embrace innovation, enhance efficiency, and secure the future of banking with cloud computing as your strategic ally. The future of banking is in the cloud – are you ready to lead the way?

Disclaimer:

This article is for informational purposes only and does not constitute financial or legal advice. The information provided is based on research and industry insights at the time of writing. Readers are encouraged to consult with financial or legal professionals before making any decisions related to cloud computing in banking or any other financial matters. The author and publisher do not assume any responsibility for the accuracy, completeness, or reliability of the content contained herein.